Lansdowne report: 2025-06-10

Submitted by Alexandra Gruca-Macaulay, Chair

Lansdowne 2.0 Construction Impacts Zoom Meeting between City of Ottawa and Community Association Representatives, May 28 2025

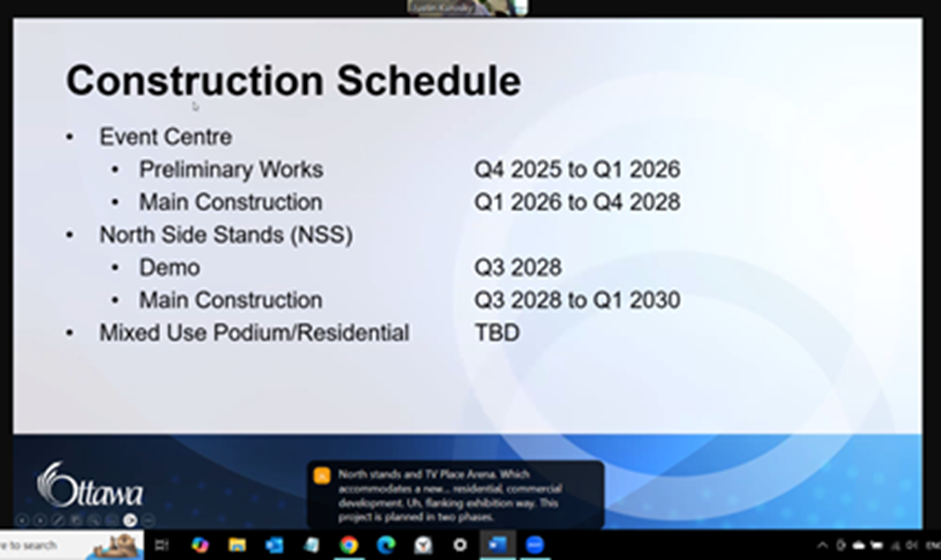

Final approval for Lansdowne 2.0 (L 2.0) redevelopment will be sought in Q4 of 2025, but in the interim, the City continues to move ahead with activities such as rezoning and planning.

A virtual meeting was held on May 28, 2025 to brief CAs on construction impacts. At John Dance’s request, City has agreed to put together an information package that can be shared with our CAs.

In the interim, some information of note:

- Retail Podium TBD, but estimate is that podium construction would be completed in 2033.

- Great Lawn will be used for construction staging and will be hoarded-off until 2028 Q3. No events will be held there during that time and there will be no public access.

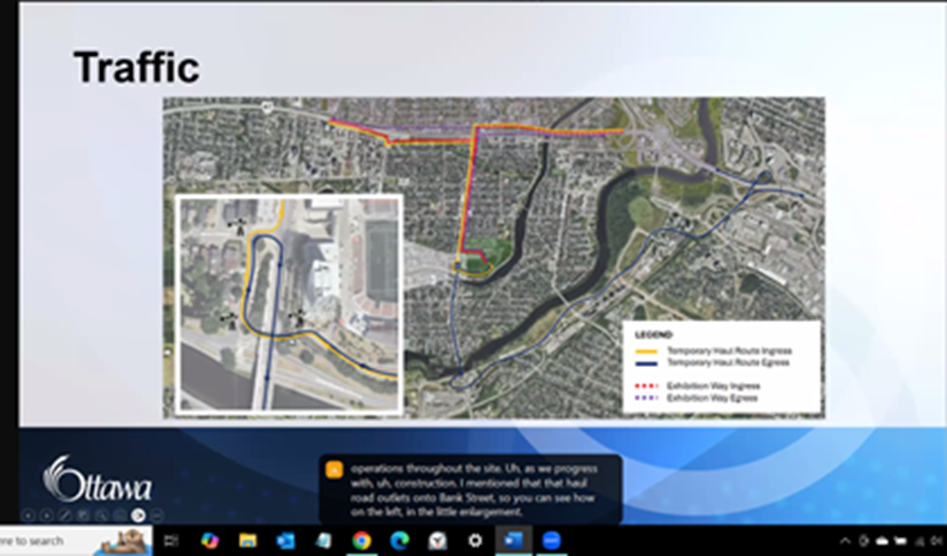

- Trucks will be travelling from 417 down Bank St. and also travelling south to Riverside Dr. to

417. Access road will be behind TD place, under Bank Street and through to Wilton.- Peak construction times will see 18 to 20 trucks per hour travelling through.

- 200 construction workers are expected on-site daily.

- Parking spots for construction workers allocated in garage.

- City has not planned any traffic mitigation measures for Bank St. during construction.

A few questions:

- Q – John: How much soil will be removed for construction?

- A: Roughly 32,000m cubed of soil, could be larger for storm water management excavation

- Q – Will there be pile driving associated with the project?

- A: Yes

- Q – Alexandra: With 200 construction workers coming on site, what will that do to traffic which is already extremely congested?”

- A: Construction workers come in for 7AM, so before traffic [not true, and City was also silent on 4PM departure]

- John’s request: Requirement that trucks not be permitted to pass cyclists

- Response: Great suggestion John!

The City will look to put a document together to share with CAs (at John’s request).

Lansdowne Financials Areas of Concern

City staff have been updating councillors on the Lansdowne 2.0 financial plan. A report from OOECA’s Lansdowne Committee raises concerns regarding the Lansdowne 2.0 financial plan, and the manner in which staff have presented the various impacts and risks of the plan has been sent to Mayor and Councillors, as well as President FCA.

- Read OOECA Lansdowne Committee Report in Appendix 1

Federation of Citizens’ Associations of Ottawa (FCA) letter in support of OOECA’s financial concerns

The FCA sent a letter to the Mayor that cites the concerns over Lansdowne 2.0 financials raised

by the Old Ottawa East Community Association. FCA is particularly concerned about the increased City debt burden represented by Lansdowne 2.0.

- Read FCA’s letter in Appendix 2.

Neil Saravanamuttoo’s call to action to hold our own referendum, and his list of “6 Things We’ll Lose by Spending $500M on Lansdowne”

Through Neil’s Substack, The613, he calls for residents of Ottawa, the “People’s Committee” to host our own referendum, citing a recent CBC report where Councillor Menard’s call for a referendum was opposed by Mayor Sutcliffe.

- the613 article and link to referendum poll: https://the613.substack.com/p/city-hall-tried-to-silence-us-were

- CBC article: https://www.cbc.ca/news/canada/ottawa/lansdowne-notice-of-motion-referendum-1.7551435

Neil has also produced an excellent video on some of the things we’ll lose if Lansdowne 2.0 goes ahead. 1-minute video on BlueSky (no account required to view):

Neil’s list:

- Lose 3,000 seats and the roof on North Side Stands

- Lose 4,300 seats in the hockey arena

- Throw away $100M that was recently spent to construct the GoodLife building which will be demolished with Lansdowne 2.0

- Lose affordable event ticket prices since tickets will now be surcharged

- Lose half the height of the toboggan hill

- Lose 40% of the green space behind Lansdowne

Councillor Menard’s article in the Ottawa Citizen, “Lansdowne 2.0 would cost more but offer much less”

“Aside from the huge cost, what’s surprising is that the Ottawa Sports and Entertainment Group and the city are actively planning for a worse experience for both sports fans and park goers.” Councillor Shawn Menard, Ottawa Citizen June 10, 2025

- Link to article: https://ottawacitizen.com/opinion/lansdowne-cost-more-offer-less

Appendix 1 – Selective sharing of key information for Lansdowne 2.0 (L 2.0) puts taxpayers at risk

Summary

The main pillars in the City’s narrative in support of L 2.0 are:

- The only outcome possible from rejecting OSEG’s L 2.0 proposal is huge costs to the city;

- L 2.0 essentially is guaranteed to generate strong cashflows, costing taxpayers only $5M/year, and eliminates the need for OSEG members to cover shortfalls.

However, the City’s staff reports have major flaws and omissions, including:

- An alarmingly simplistic, overly pessimistic, and incomplete estimate of “The Cost of Doing Nothing” (i.e., if OSEG walks away from its deal at Lansdowne).

- Presenting selective financial data – making L 2.0 look more positive & less risky than it really is by failing to clearly explain or evaluate the financial risks to taxpayers that EY identified in its due diligence report.

City’s Oversimplified “Cost of Doing Nothing” estimate

A more accurate and useful estimate would include, at a minimum:

- Ernst & Young’s (EY) cashflow forecast for Lansdowne 1.0 (positive cashflow without ~$500M spend)

- Estimate of net payout of OSEG Equity

- Inclusion of Facility Repair and Refurbishment Scenario in Financial Projections

- Assessment of Management Performance

- Disclosure of Legal Disputes and impact of fees on financials

- Discussion of potential cost savings from eliminating OSEG Related-Party Transactions.

Presenting selective Financial Data to put Lansdowne 2.0 in best light possible, while minimizing risks identified by EY

- EY Cashflow projections tell an important story ignored by Staff

- City has made significant investment in Lansdowne compared to OSEG’s “Equity”

- Lansdowne has continued to load on retail debt – is Council being properly informed?

- $20M Line of Credit earmarked for Lansdowne 2.0 construction period already accessed…why?

- The extent of City’s growing Lansdowne Debt exposure not clearly communicated.

EY-Identified Serious Risks in Lansdowne 2.0 that are ignored/downplayed

- Warning of lengthy 40-year projections: Inherently risky, reduced accuracy in such a forecast.

- Sports Revenue Risk: Tied to team performance – and no commitment beyond 2032.

- Competition from sports/entertainment district at Le Breton (also now, Live Nation Rideau venue)

- Ticket Surcharge Risks: EY says significant risk to City, no control over ticket sales/pricing.

- No Opportunity Cost Analysis: ~$500 million vs. other City priorities or better locations.

- OSEG’s Poor Track Record: Not meeting its own projections to date/losses, cost overruns.

Conclusion

Lansdowne 2.0’s financial plan will shift more risk onto the City, add significantly more long-term debt while relying on uncertain cashflows to service that debt, and ignores reasonable alternatives that could cost far less.

Council has an opportunity to exercise proper oversight and develop a more prudent and beneficial Lansdowne strategy with less financial risk. Lansdowne is currently running at essentially break-even on a cash flow basis (it has averaged break-even on cash basis in last 3 years), and as per EY, is expected to do that and better beginning just 5 years from now in 2030. As a responsible partner, OSEG should be willing to agree to this.

Detailed discussion

Oversimplified and overly pessimistic “Cost of Doing Nothing” estimate

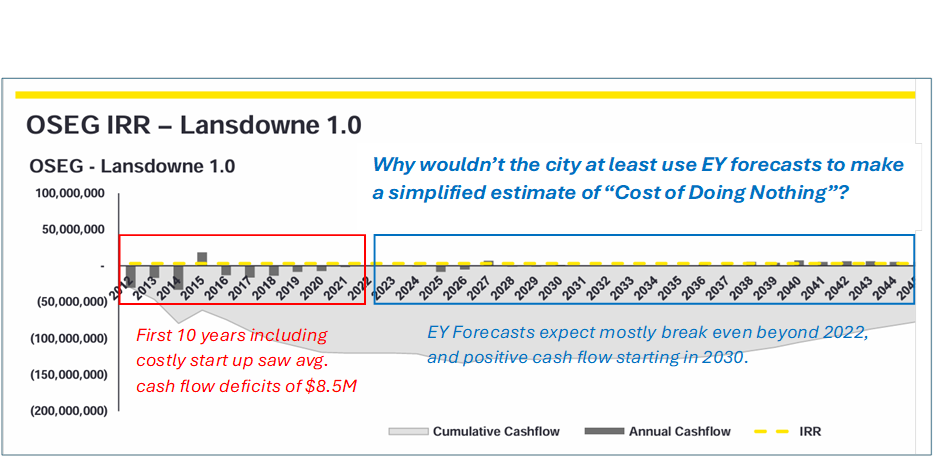

One of the City’s main arguments for Lansdowne is that the “Cost of Doing Nothing” is approximately $8.5 million a year, and possibly up to $12.5 million. However:

- When pressed for analysis to support these numbers, the city has provided none.

- Instead, Staff now point to $8.5M being based on the sum of cash flow deficits over the first 12 years of operations (net of 2020-2022) and dividing by 10 – which is not credible given it includes costly initial start-up years that are irrelevant to any estimate going forward, and,

- This is total disconnect from the independent analysis provided by EY in its 2023 Due Diligence Report that shows Lansdowne 1.0 running essentially at break even starting in YE 2022 (the past 3 years have average break-even on cash flow basis), followed by it being cash flow positive as of 2030 – which is only 5 years from now.

- EY’s graphic below (annotated with red and blue text for emphasis) clearly depicts this.

Graphic Source (not annotated): Ernst & Young Lansdowne 2.0 Financial Due Diligence City of Ottawa Reliance Restricted report, September 13 2023, p. 89

As EY reported:

“Under this scenario, annual cash flows become positive for a short period in 2015 and 2027 and then starting again in 2030.”

If the city is to use a simplistic approach to evaluating the cost of doing nothing (i.e., rejecting L2.0), why would they at least not base it on EY’s actual forecasts? These forecast show that “doing nothing” comes with better days of cash flows ahead, and having avoided a $500M spend.

That being said, a more robust and useful analysis of “The Cost of Doing Nothing” would include:

Net OSEG Equity Payout Estimate

In its reports the City has inferred that a default by OSEG would mean that the City would need

to pay out $160.5M in equity contributions to OSEG, a figure that significantly inflates actual net

payout.

The City should present a more accurate approximation of what would be owing to OSEG vis-à-

vis its equity that nets out equity amounts that would be owed to the City:

OSEG Equity total reported $160.5M

less equity already repaid to OSEG (reimbursement of roof repair expenses 2015) (23.5M)

Total current OSEG equity outstanding: $137M

Less: Equity amounts owing to City – Total City Equity: $59.2M

- Deemed Equity $23.7M

- Accrued Interest $19.5M

- Funding Equity for Roof Loan $16M (approx. amount; conversion to equity in terms of OSEG/City disputed roof repair settlement)

Payout to OSEG $137M less City Equity of $59.2M = $77.8 M

In a default scenario the approximate net payout of OSEG equity would be about $77.8M, a significantly smaller amount than the $160.5M regularly presented. In such a scenario the City would save at least $400M in L2.0 funding costs that include $17.4M of annual (main project + parking) 40-year debt payments.

Notably, under a default scenario, the City who owns all the buildings at Lansdowne would be in a position to receive all of the retail rent revenues directly, and would no longer be required to “share” positive cashflows from a waterfall.

Inclusion of Facility Repair and Refurbishment Scenario in Financial Projections

The City claims that rejecting Lansdowne 2.0 means letting the site fall apart. But they haven’t considered more realistic and cheaper alternatives to upgrade the arena and stadium.

Repeatedly ignored is the City’s commissioned engineering report that noted that the stadium, currently valued at roughly ~$100M, can be maintained for another 40 years for $1 million a year. Will it meet every desired aspect of functionality? No. But it can be improved at far less cost.

Strangely, City staff claim that the city is compelled to act – to protect a city-owned asset – spending roughly $500M to build brand new facilities at Lansdowne. But staff fail to mention that the same standard is not applied to public arenas serving communities across the city. Many do not meet accessibility requirements, have been neglected and left to slide into disrepair or possibly forced closure due to lack of funding.

As part of a 2024 Capital Asset Report to Council, fully 16 of 25 city arenas were rated by the city as either in Fair (13, including the Belltown Dome) or Poor (3, including Sandy Hill) condition. As previously explained by the city:

“Tom Brown Arena (Fair Condition) is one of many arenas that is aging and will require significant renewal investments to maintain operations. It has the usual list of deficiencies that include falling short of meeting accessibility requirements, dressing rooms that are too small… etc.” (email from GM, Recreation, Cultural Services, and Facilities, May 2023).

No mention is made of how decisions to spend $500M at Lansdowne will impact the city’s ability to afford maintenance of deteriorating arenas and many other infrastructure across the city.

Assessment of Management Performance

Given that Lansdowne has underperformed for over a decade, this lack of analysis is a major

oversight. Specifically, the City should:

- Produce its own analysis of why Lansdowne’s financial performance has been so poor.

- Evaluate whether management performance contributed to these results.

- Analyze whether savings could be made if, instead of OSEG, the City or a non-profit board were to operate the facilities, with OSEG continuing to run Redblacks and 67’s and rent facilities at market rates.

Disclosure of Legal Disputes and Impact of Fees on Financials

Various Lansdowne-related entities have been involved in lawsuits, none of which are ever

mentioned in staff reports. These may have affected cashflow and also raises further questions

about management effectiveness and transparency.

Discussion of Risks from OSEG-Related Party Transactions

OSEG investors and their businesses regularly transact with the partnership. These non-arm’s-

length deals could be adding more cost to operations.

More fundamentally, no credible analysis has been undertaken of options should OSEG walk away from a deal that it proposed. No consideration has been given to a renewed business model that could involve either the City or a non-profit Board providing management oversight to Lansdowne Park as a whole. Sports teams, facility and retail leasing operations could be contracted directly and transparently, in the process facilitating improved oversight by Council.

Selective Use of Financial Data that overstates positives and minimizes risks

EY Cashflow projections tell an important story ignored by Staff

The City claims that Lansdowne 2.0 will generate positive cumulative cashflow quickly, but

EY’s projections show otherwise. EY concluded:

- Under Lansdowne 2.0, the City won’t see positive cumulative cashflow until 2054-55.

- Under Lansdowne 1.0 (if nothing new is built), positive cashflow starts around 2030.

- The City earns a higher rate of return by “doing nothing” (4.13% vs. 2.4%).

This shows that the City has been presenting overly optimistic and partial data that doesn’t match

EY’s more complete and cautious outlook.

The city’s assertion that L 2.0 “will only cost taxpayers $5M/year” is to pretend that this is virtually guaranteed. Not only is it not guaranteed, but also as EY pointed out, any cash proceeds from the Partnership (which the city would rely upon heavily to eventually pay for the debt) are largely not expected until the 2 nd half of the 40-year deal, while the $17.4M annual 40-year debt payments will be required from the outset. In the meantime, taxpayers will have to make up the difference, using funds that could go to other city priorities. The city is essentially silent on this issue as well as minimizing the inherent risks that EY outlines of having to wait so long for hoped-for returns.

City had made significant investment in Lansdowne compared to OSEG’s “Equity”

The city makes much of OSEG’s equity contributions of $160.5 million to the Partnership as an “investment”. But the $160.5M equity contribution is an inflated figure. Staff reports note that OSEG was paid back the $23.6M for disputed roof repairs – but don’t clarify that means that total equity is actually $136.4M. Even then, OSEG’s “equity” largely doesn’t reflect new investment — the reality is that it is mostly made up from construction cost overruns during Lansdowne 1.0 which they managed, and covering cash flow losses (for which they earn 8% interest) – for a business model that OSEG proposed to the city and has been responsible for operating.

Lesser mention is made of the City’s significant expenditure of about $210 million on Lansdowne 1.0, and current balance of roughly $100M in debt. Under Lansdowne 2.0, the City will spend another $419.1 million plus $18.6 million for parking — totaling $647.7 million in public spending. And that number is likely to increase.

Lansdowne has continued to load on retail debt – is Council being properly informed?

OSEG added $10M as a 2nd mortgage in 2021. Council was advised after the fact that Staff had used delegated authority to approve this. Further, that the cash injection was used, “to keep operations afloat”. However, OSEG is obligated under the Partnership to cover cash losses. Was staff authorized to approve this debt, for this purpose, without seeking Council approval?

In addition, OSEG added a further $10M in mortgage debt in 2023 when they refinanced the primary mortgage from 2014. But Staff only reported having used delegated authority to approve refinancing of the primary mortgage for $120M, and rolling the 2nd mortgage in. No mention of a mortgage principal top-up. Now, Staff claim the extra $10M was used to recover capital costs from prior years without providing further details requested regarding the purpose of these funds. Was staff authorized to approve this debt for this purpose without seeking Council approval?

$20M Line of Credit earmarked for Lansdowne 2.0 already being accessed…why?

The April 2024 “Procurement Options” report also authorized a $20M Line of Credit for the purpose, “…to fund cashflow requirements through to the end of the Lansdowne 2.0 construction period…. This is because cashflow deficiencies will likely increase during construction … over the two-year period when they are demolished and subsequently rebuilt”. (bolded for emphasis; LOC is to be rolled up into retail mortgage).

While Council would reasonably interpret that the Line of Credit was only intended for use once Lansdowne was approved and shovels in the ground, staff have confirmed that it is already being accessed (they won’t say how much). They point to the words “through to the end of the Lansdowne 2.0 construction period”, as the “greenlight” to do so. In other words, starting immediately. If actually to support cash flow now, which is OSEG’s responsibility, did Council give informed consent?

Does Council understand that the plan is to roll this “construction” line of credit into the retail mortgage, and also to add in approximately $40M of retail podium construction costs at the end of construction?

EY warned about increasing debt at Lansdowne, and yet retail mortgage and interim LOC debt has been growing since 2021. The Partnership technically pays the mortgage, but if it defaults, the City would almost certainly be compelled to step in and assume the debt, so this creates real financial exposure.

The extent of the City’s growing Lansdowne Debt not clearly communicated

The City still owes ~$100 million from Lansdowne 1.0 and would owe $331.3 million more under Lansdowne 2.0. The new annual debt payment would be $16.4 million for 40 years (plus $.10M a year for parking project). City staff claim the impact will be just $5 million annually, assuming projected cashflows are realized — a highly optimistic assumption. EY warned that because Waterfall returns to the city under L 2.0 are planned to come very late, the City faces added risk.

The City is responsible for construction cost overruns (rather than OSEG – this is new for Lansdowne 2.0) as well as any additional capital requirements of the arena and stadium, which likely would mean locking itself into spending even more to protect its initial investment.

Since Lansdowne is classified as “legacy” spending, the City can raise property taxes as much as needed to cover the debt costs. Yet, the risks, uncertainty, and long wait for returns suggest this is a poor use of such a large debt load.

It is not clear that Council is being given opportunity to provide appropriate oversight regarding the combined picture of the city’s Lansdowne related debt now and in the future.

EY Identified Serious Risks in Lansdowne 2.0 that ARE ignored/downplayed

“Based on the foregoing, there are a number of factors that elevate the overall risk profile of the Lansdowne 2.0 redevelopment project above other competing projects of similar scale.” (Source: Ernst & Young Lansdowne 2.0 Financial Due Diligence City of Ottawa Reliance Restricted

Report, September 13 2023, p. 87.)

EY flagged many risks – indicating that Lansdowne 2.0 is more uncertain than similar projects of its kind. Projections are “realistic”, but ONLY IF many things all go right. Numerous risk factors and caveats run throughout EY’s due diligence. The city downplays the risks identified

by EY in its report, including, but not limited to:

- Warning of an overly long 40-year projection period: Inherently risky, and EY warned that its economic model may not accurately reflect what will happen over such a long time.

- Sports Risk: Revenues are tied to team performance – Redblacks have below-average attendance, and north side stands without a roof won’t help this. OSEG has not committed to teams staying beyond 2032.

- Competition from a new sports and entertainment district: A Senators arena downtown (and now Live Nation’s new 2,000-seat venue) both served by the LRT, pose major competition.

- Ticket Surcharge Risks: The City assumes it will recover significant costs through ticket surcharges. But EY says the City takes on all the risk, with no control over ticket sales or pricing.

- No Opportunity Cost Analysis: No analysis was done to weigh this ~$500 million investment against other city priorities or better locations, such as one served by the LRT.

- OSEG’s Poor Track Record: OSEG has failed to meet its own projections to date, incurring initial cost overruns, and steady operating losses. The City hasn’t disclosed EY recommendations rejected by OSEG that impact financials.

Conclusion

City staff present selective data and minimise major risks in their framing of the proposal for Lansdowne 2.0. Council has been given an incomplete and often misleading picture. Lansdowne 2.0’s financial plan will shift more risk onto the City, add significantly more long-term debt while relying on uncertain cashflows, and ignore reasonable alternatives that could cost far less.

Council has an opportunity to exercise proper oversight and develop a more prudent and beneficial Lansdowne strategy with less financial risk. Lansdowne is currently running at essentially break even on a cash flow basis (it has averaged break even on cash basis in last 3 years), and as per EY, is expected to do that and better beginning just 5 years from now in 2030. As a responsible partner, OSEG should be willing to agree to this.

Alexandra Gruca-Macaulay, B. Comm. FICB (Fellow, Institute of Canadian Bankers)

Carolyn Mackenzie, B. Comm.

Appendix 2 – FCA Letter to Mayor, City Council

June 4, 2025

Mayor Mark Sutcliffe Members of Council City of Ottawa

Dear Mayor Sutcliffe and Members of Council,

RE: FCA Concerns about the financial implications of Lansdowne 2.0

The Federation of Citizens’ Associations wishes to share its concerns regarding Lansdowne 2.0. This topic is appearing more and more in our list of issues. It was raised by concerned residents at our last general meeting and we have recently been made aware of a report by one of our member organizations, the Old Ottawa East Community Association, regarding the long term financial implications of the project.

As you may know, we have recently been in communication with the City’s Chief Financial Officer precisely over our concerns for the long term health of the City’s finances, the City’s debt load and the deteriorating state of its infrastructure assets. For example, according to the recently released Asset Management Plan only $4.8B of our $10.8B asset maintenance shortfall is planned to be funded in the next 10 years.

In this context, our general view is that there are still many unanswered questions regarding the financial plan for Lansdowne 2.0 and we believe it to be an extremely risky proposition for the city’s rate payers.

Paul Johanis

Chair, Federation of Citizens’ Associations

Alexandra Gruca-Macaulay

Chair, Lansdowne Committee